Solar project M&A - Chaos on the buy side

Chaos on the buy side of solar project M&A is not new, but the highlights from 2024 are striking - especially for sellers unaccustomed to these patterns of change.

Did you feel like the IPPs in 2024 were all over the place? It’s easy to feel that way. This post highlights some of the chaos that we witnessed last year across the buy side of the M&A market for C&I and community solar projects. But we’ve actually come to expect this, having witnessed it year after year, and you probably should too.

As a platform supporting renewable energy project funding, we see a lot of deals. We also see the aggregate behavior of buyers and sellers and its patterns. Everyone knows the deals they’re working on and the behavior of those counterparties. But without more data points, it’s hard to know if those behaviors are unique to those parties or part of a broader trend.

This is especially true for sellers who experience shifts on the buy side. One moment you’re working with a buyer who prices competitively and seems eager to close, and the next moment they’re changing their price - and not for the better - or backing out of the deal entirely. What happened? Was it me? Was it them? Was it the project? Or was it a broader trend like rising hurdle rates across the market?

The only constant is change

We help sellers make sense of this kind of experience and find a new party to work with. But we’ve seen these patterns so frequently that we’ve actually come to expect them. And if we could convey one universal truth to all developers, EPCs, and project sellers across the middle market, it would be this: the buy side of the market is constantly shifting.

Highlights from 2024

Last year was no exception. We saw changes in pricing, changes in project size requirements, changes in timeline requirements for project development and funding, and even leading investors in specific market segments abandoning those segments entirely. Here are the highlights:

Multiple buyers across C&I and community solar raised their goal posts for deal sizes, dropping or postponing anything in their pipeline that didn’t meet the new threshold.

We consistently saw C&I buyers raise their threshold for investment from $1M, then to 1MW, then to $2M, etc.

A leading PPA provider abandoned their pipeline of all sub 1MW (or is it 2MW?) projects altogether

Multiple community solar buyers increased their minimum size threshold for transacting - often to 15-20MWs

Multiple buyers found projects that “no longer fit with their pipeline” and turned around to sell them, and we don’t believe that this was the original intent from most of these buyers

Multiple PPA providers abandoned the C&I market altogether

Multiple smaller buyers chose to focus exclusively on current year CODs, while many larger buyers chose to focus only on projects that would reach COD in 2025

Multiple experienced buyers who had previously focused on earlier stage acquisitions started buying projects at NTP

Multiple experienced buyers shifted to buying earlier stage community solar projects, as they found themselves routinely uncompetitive at the NTP acquisition timing

But was 2024 unique from prior years? Will 2025 be any different?

In short, no. This is the way this market has functioned historically and will continue to function. Sure, macro trends like policy shifts, interest rates, supply chain issues, and other changes impact everybody. But why do so many individual companies shift their focus so dramatically?

Our perspective here may be different from what sellers see in their interactions with deal origination teams at buyer organizations. These groups identify investment opportunities and move deals from a first conversation to pricing and LOI all the way through diligence to closing. We work with them too, they’re great folks. But they’re often surprised by the shifts at their own companies.

The decision making that drives dramatic shifts from buyers occurs among senior executives. It’s informed by the pricing, capacity, and timing of their capital sources, including debt and tax equity, along with their viewpoints on shifting market conditions. These are not decisions taken lightly. These teams are managing hundreds of millions or billions of dollars in institutional capital. But the market for those capital sources is dynamic too. And the solar coaster is fierce.

In a recent episode of the Open Circuit podcast, Jigar Shaw mentioned 9 commercial solar platforms for sale right now despite the strongest demand we’ve ever seen for solar and battery storage among commercial customers. He attributes this buying opportunity to mispricing in 2024, prior to the election - which itself is adding uncertainty. For all of these reasons, we’re expecting new shifts on the buy side in 2025, just like in 2024 and in previous years.

What to do about it

All of this points to the importance of having multiple offers from high quality buyers. Here are our recommendations for for sellers bringing projects to market in 2025:

Find multiple buyers who are a real fit for any given project or portfolio, not just “interested.” You should be able to tell which buyers are “interested” and which buyers are “hungry” for your projects or portfolio. You want to work with those who are “hungry” for it.

Assess their team’s eagerness and ability to execute alongside their pricing.

Leverage Conductor to do this efficiently and effectively for all of your projects across size, geography, and offtake type. Most sellers take a pulse on the market once or twice a year, we’re in this daily and it helps us accelerate the deal making on our platform.

Portfolio Construction

In project finance, the portfolio effect is well known. The tricky part is deciding which mid market solar projects to group together to make it work.

Developers and EPCs are almost always working on more than one project. But their projects vary by timelines, offtakers, locations, and pricing. This works fine for one-off cash deals and customer-owned C&I projects. But it creates a puzzle for third party ownership, particularly with portfolios.

In project finance, the portfolio effect is well known. If you can group a set of projects together into a portfolio, you’ll get better pricing from buyers. Economies of scale allow buyers to deploy more capital at lower cost per project, improving overall pricing for the portfolio.

The tricky part is deciding which projects to group together to make this work. If it were as simple as throwing any project into the mix, developers and EPCs could include their whole project pipeline from speculative origination through mechanical completion across C&I and community solar projects in seven different states. But investors don’t work that way.

Our investors are IPPs who manage funds that align with specific project profiles and specific time periods. This makes them interested in some projects and not others, and some projects more than others. And their priorities are constantly shifting in subtle and not-so-subtle ways.

For developers and EPCs, these dynamics make project financing feel like a moving target. One of the reasons they use our marketplace is to find the right investor at any given time. But these challenges are compounded in portfolios, where some investors will bid on more projects than others and different projects than others, creating a multi-dimensional matrix of potential bid configurations.

What makes a portfolio?

We’re frequently asked about the right portfolio construction, which projects to market together, and even what a “portfolio” means in the middle market. The right answer is the combination of projects that maximizes value for the seller. But the specifics of how to get there vary considerably.

Our software is very flexible for portfolio construction. We don’t have hard and fast rules for projects that can and can’t be combined. And we’ve found success in the market with a wide variety of portfolio configurations. But this experience has given us a perspective on the most important factors to consider when aligning projects for a portfolio acquisition. Here are our top five:

Counterparty consistency

Development status

Offtake type

Geography

Target COD year

Counterparties: Having as many similar counterparties across the portfolio is fundamental, as it creates economies of scale for the transaction. At a foundational level, this starts with the same seller, which is who ultimately controls all of the projects. For C&I projects, having customer consistency is the next most important (e.g. many different sites with the same PPA counterparty). Lastly, to the extent that EPCs are included in the portfolio, it is much more attractive to have a consistent EPC across the projects. The EPC is a substantive counterparty for the Investor to approve, with a heavier document for them to negotiate.

Development Status: Economies of scale also come from projects transacting at the same time in their development cycle (e.g. in development, NTP, mechanical completion). This allows buyer and seller to use the same contract documents and manage project execution similarly across the portfolio. It also creates more consistency in pricing. Financing sources change from year to year, or sometimes even within the same year, leading to potentially undesired changes for projects at different stages of development.

Offtake Type: Most investors specialize in projects with a particular type of offtake (e.g. C&I, community solar, or small utility). Some may be interested in both C&I and community solar, or both community solar and small utility projects. But we rarely see investors excelling with competitive pricing and execution efficiency across multiple offtake types. Even similarly sized projects within the same state may benefit from having different investors who specialize in the projects’ associated offtake.

Geography: The nuances of mid market solar projects at the local level are too many to list here. These include utility programs and interconnection, state subscription and incentive programs, permitting processes and policy structures. Investors are much more likely to lean into projects in places where they have experience or where their teams have done significant research. This allows them to move faster and with more confidence.

Target COD Year: It might be counterintuitive to see COD timing at the bottom of our list here, given tax credit financing’s outsized role in the solar industry. But investors buying projects in our marketplace manage multiple funds across calendar years, giving them flexibility. We do see price adjustments in LOIs tied to COD timing, so this is still a factor in pricing. But that doesn’t preclude projects in different calendar years being included in a portfolio and priced together, it just may have a slight impact on value for each.

Risk of imbalance

The two biggest questions on sellers’ minds are how much value they’ll receive from a sale and how likely their counterparty is to execute the agreement on the terms specified. Portfolios add complexity here because any projects that do not move forward will remove a portion of the portfolio’s aggregate effect on pricing.

If a portfolio includes several similarly sized projects and one falls off, the effect may be marginal. A buyer may even choose not to adjust pricing in this scenario. But if the portfolio includes a project that is much larger than the others, the impact of that project falling off can be dramatic. For a handful of different PPAs across a 2MW, 500kW, and 200kW project portfolio, losing the 2MW project can wreck the whole portfolio. By contrast, the impact of one project falling out of a large community solar portfolio is likely minimal.

This is a key reason why we ask buyers to price each project in a portfolio separately, as it provides clear evidence that some projects are worth more than others.

Market insight

With these multiple factors to consider, insight into buyers is extremely helpful. A portfolio configuration that works for one buyer may not work for another. Optimizing this to maximize value requires the right set of projects and the right set of buyers.

While a developer or EPC may take a few projects or a couple of portfolios to market every year, we take hundreds. We glean insight from 50+ IPPs actively bidding in our marketplace to inform our guidance on portfolio construction. This market insight doesn’t simplify the task, but it does help us construct a portfolio that maximizes value for sellers and works for buyers who can execute.

In some cases, we even have portfolios that receive bids on different projects from different investors. This flexibility in our marketplace allows us to see how the market responds to these configurations, and adjust accordingly. And it allows sellers to evaluate the costs and benefits of working with one party on the whole portfolio vs. splitting up the portfolio to align the projects with the focus areas of multiple investors.

How we can help

Our team will advise sellers on portfolio construction prior to bringing portfolios to market. We have deep transaction experience, current market insight, and an appreciation for the nuances of solar and battery storage projects across C&I, community solar, and small utility segments. We’ve aligned our own incentives with getting deals done and getting projects built, and our process supports these objectives for both sides of the marketplace.

Choose Your Own Adventure on Conductor

We’ve just released an update that gives everyone new flexibility to see the information that they want to see, assemble internal teams for each project, and invite collaborators from other organizations.

We’ve just released an update that gives everyone new flexibility to see the information that they want to see, assemble internal teams for each project, and invite collaborators from other organizations. Companies with large teams working on many projects will benefit greatly from this, and even smaller companies can take advantage of the new flexibility.

Up until now, everyone at your company had the same experience. The same projects showed up in the same order and everyone got all of the email notifications. For some of you, it was a lot of notifications - thank you for your patience! Now you can create project teams in the app, and focus your notifications on the projects that you’re working on.

Project teams

The next time you view a project in the app, you’ll see the new “team management” tab. This is the place where you can add a colleague to a project, and even invite a collaborator from outside of your organization. Maybe the project is now in diligence and needs someone else to jump in. Maybe there is a consultant, lawyer, or engineer from outside of your company who needs to help. You can invite these folks from the new tab. If they have an account on Conductor already, they’ll show up in the table. If not, you can send them an invite to set one up.

When you are a member of a project team you can choose to receive different email notifications about a project when you’re on the team.

Project leads

You can also assign project leads that will be visible in the marketplace in case someone needs to find your company’s point of contact for a project or portfolio. Project leadership can be re-assigned at any time - for example when the project moves to a new phase of financing or development.

If you’re a developer and you create a project, you’ll automatically be assigned as the project lead. But if you’re an investor that gets matched with a project in the marketplace, Conductor will need to assign the project to someone on your team. We’ve set up default project leads at your organization for this purpose, and you can edit these in your company settings.

External project team members

People joining a project team from outside of your organization will only have access to projects to which they’ve been invited by a member of your organization. You can invite them to as many projects as you like, and there are no limits on how many team members a project can have.

For example, if you’re a developer collaborating with an EPC for engineering services, you can let them update data and documents for your project directly in the app. Or if you’re an investor working with a lawyer to review contracts, you can give them access to project documents.

Notification settings

For large teams, this might be the best part. Based on your roles as a project lead and project team member, you can now choose which email notifications you receive on which types of projects. Maybe you’re a manager who only wants to check in periodically. Maybe you don’t want an email every time someone adds a document during the diligence process. It’s all good. Now you can decide which email notifications to receive based on your project role.

Choose your own adventure

The purpose of this update is to customize your experience on Conductor, focusing your attention on the projects most relevant to you and allowing your organization to manage projects more effectively. We hope you find the new features helpful, and we look forward to hearing what you think.

It’s a great sign for us that so many projects with so much activity in the app have people asking for these kinds of controls. This update will also lay a foundation for our future growth, allowing us all to manage more projects in the marketplace more effectively.

Market Snapshot: PPA Investor Growing Pains

We’ve been tracking acceleration in solar’s middle market since the passage of the Inflation Reduction Act. Rather than an immediate burst, this growth has come gradually as policies have been clarified and implemented. We noted how this momentum was stretching the existing capacity of developers and investors last fall. These challenges have compounded through the first part of 2024. We’re taking a moment here to share our insights on where the market is, where things are headed, and what it means for developers and EPCs.

US middle market picking up steam

The biggest factor driving market acceleration so far is the gradual clarification of investment tax credit adders by the IRS. We’ve provided updates on IRS guidance before. Here we’ll focus on the three primary adders impacting PPA project pricing:

Energy Communities. The clearest and most reliable adder so far, energy communities are well understood by the market and routinely priced into financing. The key wrinkle is that some of these qualifying territories can change, so developers and investors may need to ensure that projects start construction in the right year for qualification.

Low to Moderate Income. LMI bonus credits are great, if awarded. But they are limited in quantity and about 10x oversubscribed in most categories. So qualification doesn’t mean much until the project award is received.

Domestic Content. This one has been a sleeper so far. Equipment manufacturer reticence to open their books is understandable, but it has kept most of the market from incorporating the DC adder. We don’t expect it to become a regular part of project pricing until at least 2025, maybe 2026.

A new source of momentum this year is the EPA’s $27B Greenhouse Gas Reduction Fund. With the recent announcement of $20B in awards, we expect funds from this program to start flowing into the market in the 2nd half of 2024.

The upshot of these gradual rollouts of federal incentives is steadily building momentum and a steadily growing volume of viable projects. While great news for the industry, this does create growing pains for the companies working to deliver these projects.

The squeeze on investor bandwidth

The limits on investor capacity that we noted in the fall have come back with a vengeance. We’ve seen this show up in a number of ways recently, including:

Significant hiring, particularly for investor sales reps and the build-out of origination teams to support the increased project activity.

Tightening criteria. Investors are focusing on a narrower set of project types and being more selective as to what’s a “Grade A Project” for them. The low end of an investor’s target project size has tended to creep higher.

Slower response times. More investors have struggled to hit their bid deadlines or taken more time to follow up on diligence reviews.

Investors mentioning how busy they are. We are hearing this more consistently and from more parties than normal.

What this means for project financing

With a broad view, these trends are understandable. But for an individual project, the experience is bewildering. Investors that used to be a fit and a reliable partner may no longer be interested, or may require more vigilance to keep their attention. Things can change mid stream, and rapidly. We’ve even seen investor origination teams caught off-guard by shifts at their own companies.

In this context, it’s important to remember that the fit between a project and an investor has several dimensions, including:

Competitive pricing and deal terms

Ability to execute and close deals on the terms initially proposed

Speed to close and responsiveness throughout the process

Developers and EPCs may encounter challenges at any point. And because they lack visibility into the inner workings of investment companies, it’s very difficult for them to see these changes coming. But the impact on their projects can be significant.

How developers and EPCs should respond

At the start, it’s important to get multiple offers from high quality investors. The right investor for the next project may be different than the last one. And you can’t really assess this without seeing an offer and comparing it to others in the market. Beyond ensuring a good fit and the best pricing, multiple offers also give developers and EPCs backup options in case something goes wrong. This is especially important when market shifts catch teams by surprise.

In bidding and diligence, developers and EPCs should pay close attention to responsiveness and follow-through. It’s reasonable to expect transactions to take a little longer. And some patience is important as investors work to staff up. But they still should be following through on deals in process.

Fortunately, we’re seeing great follow-through from our top investor partners, even if closing takes a week or two longer than in the past. When investors are willing to make an offer, they’ve typically shown an ability to transact on the project or portfolio.

Where this is all headed

Is this trend here to stay? Yes, very likely. The market is feeling the momentum of the IRA now, but it’s still gaining steam. As the Domestic Content adder and the Greenhouse Gas Reduction Funds really start flowing, we expect these trends to accelerate and exacerbate the current challenges.

It will take time to scale execution efficiency. Investors will be adding staff, new partnerships, and software solutions. Conductor will continue to advance our marketplace and our diligence tools to help investors become more efficient and more capable of handling larger and larger project volumes. The Conductor process starts with finding great partners and finishes with tools that help those partners transact and collaborate effectively all the way through to closing and construction.

Introducing ITC Transfers

What’s new?

Conductor Solar now supports ITC Transfers for C&I and community solar projects! Building on the success of our marketplace for PPA and lease financing, we’ve created a marketplace for developers and EPCs to facilitate tax credit transfers for their customers’ projects and to directly sell tax credits for projects that they want to own and operate.

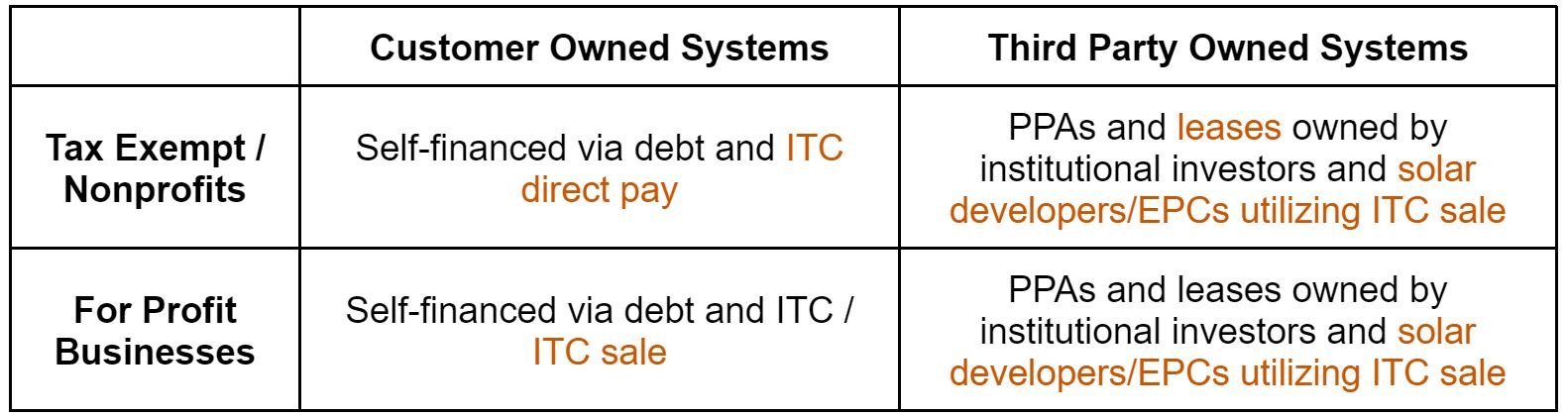

What is an ITC transfer?

The Inflation Reduction Act of 2022 included a provision allowing a transfer of the federal Investment Tax Credit (ITC). Previously, monetizing the ITC often required wither a) a certain type of tax liability, or more commonly, b) a complicated tax equity legal structure. While it’s still challenging for many to use ITCs, solar owners can now sell their federal tax credits to tax credit buyers via a much simpler structure - a one time transfer (purchase and sale).

How does Conductor help?

Conductor connects developers and EPCs with interested buyers and provides a suite of software tools and legal documents to facilitate the transaction. The software organizes project information to support pricing, diligence, and closing. And the recommended documents offer both parties a template for the term sheet and purchase and sale agreement for the transfer. We created the recommended documents in collaboration with a top tier law firm that is annually involved in the finance and sale of approximately 15 Gigawatts of renewable energy.

How will this impact the market?

We expect ITC transfers to unlock financing for a large number of new C&I solar projects with project values ranging from $50k to $10M per project. For-profit companies with limited tax liability can now consider solar energy system ownership as a viable option. This is true for both customers seeking to own their own systems and for developers seeking to provide PPAs and leases to their customers.

What about nonprofits and governments?

Nonprofits and governments don’t need to transfer ITCs because they can get paid directly by the IRS. This “direct pay” option allows these organizations that don’t pay federal taxes to receive cash from the IRS for the value of their ITCs. We are expecting these payments to come through after projects get built, so there may still be a financing need during the construction period along with any financing required for the remaining value of the system.

Tell me more

For more information, see our coverage of the Inflation Reduction Act:

How to Use Conductor

Conductor Solar is a marketplace where developers and EPCs find the best financiers for their C&I and community solar projects. We match projects and portfolios with investors by deal size, geography, customer type, and other factors to make everyone’s efforts focused on deals with the highest likelihood to close.

To do this, we collect project information from developers and EPCs and review every project before it gets matched with investors. We make sure the project economics work and the production estimate is reasonable. And we screen for common data errors and areas of misunderstanding. Our team has helped finance hundreds of C&I and community solar projects. We’re focused on saving time and money for everyone in this market.

As a developer or EPC, you can follow these steps to finance your project on Conductor:

1. Enter project details

Create a new project from your dashboard and fill in the required data fields. Documents are optional, but they can help - particularly with more unusual or complicated projects.

The required fields include the data points that investors will need to price a project. They’re organized by the main categories that drive economics including the project’s budget, revenue, and expenses. Conveniently, these are also the same data points that you can use to estimate pricing yourself.

2. Get automated price estimates

Once the required data fields are completed, “Generate Price Estimate” on the project summary page will give you a range for where the winning bid from an investor is likely to be. We find these ranges to contain the winning bid about 90% of the time for PPAs and leases, whether you’re looking for investors to bid on the project value (EPC cost + development fee) or the offtake rate (e.g. initial PPA rate per kWh).

3. Submit your project

When you’re ready to connect with investors for bids, submit your project for review. Our team will take a look and follow up with any questions within a day or two.

4. Connect with investors

We’ll connect you with up to five investors that fit your project and your objectives. Once matches are made in the marketplace, both sides can reach out and discuss the project in more detail. This is a chance to get to know who you’d be working with and clarify any outstanding questions that might impact pricing.

5. Compare your bids

Conductor sets the bid deadlines for investors, and they do a pretty fantastic job at providing bids within those deadlines for most projects. The ones that take longer have unique features that require more investigation like advanced microgrids, technologies beyond solar and battery storage, and new types of community solar revenue streams. All bids are based on the information provided by developers and EPCs, which Conductor organizes in a consistent way.

Comparing your bids involves more than just reviewing the numbers. Other factors to consider include the extent of the diligence process, vendor requirements, contractual restrictions, and the financier’s experience with particular project types. Our team will help surface these considerations so that you can make an informed decision.

6. Select a partner

Choosing an investor for a project is as simple as clicking “Accept Bid” in the app. This will tell us that you’ve chosen the group that you want to work with, and we’ll bring into further workflow tools to help everyone manage the data room for the diligence process. The more the documents area is already populated, the faster closing can be.

Interested in learning more? Check out our most popular articles on C&I solar finance:

Introducing Conductor’s New Look

Welcome back! Things may look a little different from the last time you stopped by. We’ve made a number of updates to the “user interface” here - a fancy word for what you see in the platform.

The core functionality of Conductor Solar is the same. We’ve added some new features and moved things around a bit. But projects are shared with investors in the marketplace just as they always have been.

Here’s a summary of what’s new:

Project setup: tailoring information to specific project types

Community solar: explicit questions for that project type

Battery storage: another one, do you sense a pattern here? :)

ITC transfers: a whole new way to monetize the ITC

Documents: more information, new display, and easier to navigate

Navigation: find everything you need, no matter where you are

Project Setup

Project Setup is now the first section in project data and captures elements that determine what you’ll see on the subsequent screens. Think of this like a configurator; when you make changes here other data fields change, too.

For example, a community solar project looking for a sale at NTP needs different information than a behind-the-meter customer owned project looking for an ITC transfer. Project Setup tailors the rest of the data fields, and makes them relevant to the project and the type of transaction that you’re seeking.

Community Solar

We’ve been helping developers find the right investors for community solar projects for years. But it’s always been a little imperfect in the software. With this update, we’ve added dedicated fields for community solar offtake and subscription management. And we’ve laid the groundwork for more community solar specifics in the future, for example by State and program.

Battery Storage

As adoption of battery systems has increased, so has the need to finance these systems. We’ve added batteries as a technology type, so that developers and EPCs can specify system sizes, O&M arrangements, and other key system features that influence investor pricing in the marketplace.

ITC Transfers

Okay, we totally buried the lede here. Conductor now supports ITC Transfers! There is a lot more to say about this, which we cover in a dedicated post. For-profit end-customers, developers, and EPCs can all sell tax credits to help finance new solar energy systems. And we’re building ways to make these transfers effective for the middle market.

Documents

Our file sharing system is completely customized to your project. Add placeholder containers, drag and drop files, and give access to investors when you’re ready. As a developer or EPC, you’re in full control of which documents are included and who gets to see them.

The Documents section now has folders on the left and files on the right, so it’s easier to click through and see the status of each document at a glance. And you can now edit the document list on the same screen to configure the listed files any way you want.

Navigation

The biggest change you’ll notice is probably the new site navigation. We’ve added a left-hand menu to find projects and portfolios along with notifications and user settings. This makes it much easier to access things, no matter where you are or what you’re doing in the app.

Another change with navigation is sub-menus for project data. Within overview, budget, revenue, and expenses the sub-menus make it easier to navigate to all of the data fields and reduce the amount of scrolling required.

Messages, which were previously in the project summary, now have their own section. This makes them easier to find and will enable some great new messaging features in the New Year.

More to Come

This update is also important beyond these specific improvements. The new user interface lays the foundation for the rest of our roadmap and will accelerate our development of new features throughout the app. What you see on a page is really a language of interrelated visual elements. We’ve built a lexicon here so that we can write software better and faster. So we’re excited to share this update, and equally excited for what’s to come.

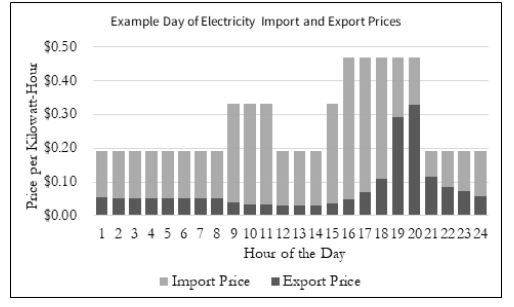

Macro Update on Project Hurdle Rates

The Fed has been increasing interest rates to combat inflation since Q1 2022, including four hikes already this year. The most recent one was in July, so why is the industry all of sudden buzzing with concern about hurdle rates rising and project buyers having to renegotiate deals?

The Fed has been increasing interest rates to combat inflation since Q1 2022, including four hikes this year. The most recent one was in July, so why is the industry all of sudden buzzing with concern about hurdle rates rising and project buyers having to renegotiate deals?

In the past month, the Conductor Solar team has heard that “project hurdle rates are going up” at least a dozen times, which is more than we heard that phrase in all the prior months of 2023 combined. Projects and portfolios are coming back to the market more often than usual, and developers aren’t seeing the value that they once thought was possible. This sudden change is frustrating and it doesn’t make sense on its surface when you compare it to the consistent Fed rate hikes over the prior 18 months.

The question we get asked most often is: if the fed funds rate has only risen 0.50% since May, why are project returns getting hammered? The easiest way to answer this is by looking at the 10-year treasuries rate, a better benchmark for solar project return targets.

Source: fred.stlouisfed.org

Why is the 10-year Treasuries Rate a good benchmark?

Solar projects have a long life, typically 20-35 years. Most revenue contracts are in the 15-25 year range. Projects are typically financed with some mix of sponsor equity, project debt, and tax equity. For simplicity, let’s assume the following mix of those three sources:

As you can see above, approximately half of a typical solar project is financed by debt. Debt is sized based on the contracted revenues of the project and the weighted average timing for those cash flows tends to be around the 10 year mark, which is what makes the 10 year treasuries a good comparison for project debt pricing.

How does this impact the project’s hurdle rate?

When we talk about a project’s “hurdle rate,” we generally mean the unlevered IRR. This is the return metric that doesn’t care about how an investor finances the project and is what Conductor Solar uses to estimate its autopricing. This is the true north for a project’s valuation, and is a simplified way to view the world that works the majority of the time. However, since investors really do care about their equity returns, it makes sense to dig a level deeper here. We’ll highlight how the market forces are impacting each of the key parts of a solar project’s capital stack.

Project Debt: This is what’s impacting rates the most. As you can see in the 10-year Treasuries chart above, that pricing has increased 1.40% in the past few months. While other factors are at play, it’s safe to assume that the cost of debt for solar projects also has increased by 1.40% in the same period.

Tax Equity: For purposes of this article, we’re going to keep things simple and assume that tax equity is unchanged. There is reason to expect some tightening here too, at least in the short term, and we’ve seen some evidence to this effect. But the tax equity market is very dynamic right now in the context of these macro trends and the recent introduction of tax credit transfers.

Equity: This is the riskiest part of a solar investment, as it is repaid last after debt and tax equity. Investors in solar project equity often compare its returns with other general asset classes. As it becomes easier to invest in things like 10-year treasuries to earn a decent return, it means that the equity for solar projects needs to provide slightly higher returns to continue attracting investment. While this lags a bit behind the 10-year treasuries rate, the general impacts from rate hikes over the past 18 months are starting to show through here, too.

The Bottom Line

The impacts of all of these changes are that the unlevered IRRs for solar projects are increasing by ~1.00% in order to continue attracting project buyers. That can have a pretty dramatic impact on a project’s value, upwards of a 7-10% reduction on the total project value. If you’re a developer who waited until the project was fully derisked, you might find that your project isn’t commanding anywhere near the value that you thought it would.

Guidance for Developers

If you run into trouble with a project, use the Conductor Marketplace and find new offers

If you’ve signed an LOI but have not yet contracted, confirm your investor’s pricing

Have patience with investors, who are doing the best that they can while the cost of their money is constantly changing

Guidance for Investors

Keep every commitment that you can, to maintain credibility

Communicate early and often if something in a deal needs to change; and be transparent demonstrating why - so it’s clear to your developer that this isn’t just a grab for more value

Expect that developers will seek alternatives, and keep their loyalty by continuing to be a great partner in every way possible

Conductor’s Take

An inherent asymmetry is present once exclusivity is granted; developers rely on their investors to be credible, trustworthy, and to follow through on their offer

Investors get a bad reputation if they exploit this asymmetry with great offers during bidding that get rolled back during diligence. Bait and switch.

That’s not what’s happening here, for the most part. But it probably feels the same to many developers.

Conductor screens investors and works with high integrity shops who price competitively and follow through with solid execution. This is very hard to screen up front, which is why we leverage our insight into their behavior through dozens of deals with different parties. And this is very valuable for our developers, especially when they’re looking for a new investor partner.

Anytime Data Room

This fall is shaping up to be super exciting for product updates at Conductor. We have a couple of big ones coming in a few weeks. To kick off this season here’s a nice addition to the marketplace: data rooms for projects at any stage.

Most people see data rooms as a place to share files, but they can be so much more. We’re making data rooms sexy. That’s right, you never thought you’d hear it, but it’s true. And as a key foundation for any solar deal, a good data room is more important than most people realize.

A big problem with data rooms is that each party has their own file structure and naming conventions. But in this industry we don’t all speak the same language. Misalignments on file structures and file naming are silent killers of solar deals, and that’s a sad sad thing.

We’ve pulled from years of slogging through diligence on billions of dollars of transactions with dozens of counterparties to create something specific to the solar industry: a consistent file structure and naming convention for every deal in your pipeline. And we’ve added tools to make sure that nothing is lost in translation, like automatic remaining of files for all parties.

Our estimate is that deals using our data rooms close 10% faster and 1-2 weeks sooner, saving over 50 person-hours across the deal. Developers and investors doing deals on Conductor love these features, but up until now they could only access them after a bid was accepted. Now developers can use data rooms for all of their projects, even before getting bids.

What We Heard

It’s pretty common for investors to ask developers for project documents before bidding. Knowing certain details or having confidence in certain aspects of a project can impact their pricing. We noticed this behavior a few months ago, and quickly added a lightweight version of document sharing in the app. But everyone asked for more. A doc or two isn't hard to manage with a simple drag and drop, but unique and complex deals benefit from more structure.

Developers also asked for a way to organize documents for their own teams. Long before they engage with investors, developers manage project documents. Wouldn’t it be great if they could use the same data room that an investor uses later on? Bingo.

What We’ve Built

Worst kept secret: this is not a new feature! We had most of this functionality in the app already. We had just been hiding it until a bid was accepted in the marketplace. Shame on us.

We had to tweak a couple of things in the data room to make it work earlier in the deal, like who does what when. Developers can now set up their own data room while they’re drafting a project or getting bids. They can decide who sees the data room and when. Once a bid is accepted and the project moves into diligence, everything that the developer sets up becomes a great starting point for the investor. An investor can modify the list of documents and manage document approvals, with the added benefit of already having some docs in place.

So, one developer wants to use the data room internally until they select an investor - all good, that's the default. Another wants to share docs with an investor after signing an NDA - easy. Another wants to share a few docs with all active bidding investors - simple. What about just sharing one doc with one investor? We’ve got that too. Until a bid is accepted, developers have full control over who sees their docs and when.

Consistent across these timelines and all of these scenarios is our file structure, automatic document renaming, and the flexibility to select common documents and add custom documents. And we make it easy to see a status snapshot at-a-glance:

What Comes Next

So much to say here! Our data rooms will only continue to improve, and we really appreciate the feedback we’ve received so far. We’ll keep adding features and functionality and make data rooms sexier than anyone could have ever imagined.

In a few weeks, we’ll be sharing more product updates. Conductor supports a huge variety of solar projects, from a 50kWdc rooftop to portfolios of 5MWac community solar ground mounts with and without battery storage and all across the country. We’ve managed pretty well so far fitting all of these things into one platform. We’re about to make it easier to manage for everyone.

The Inflation Reduction Act - Current Guidance

A year ago, senators Chuck Schumer and Joe Manchin reached a historic deal to advance the clean energy economy in the US. The Inflation Reduction Act was signed into law in August 2022, but the administrative guidance for the legislation has taken months to clarify. Of particular interest to the commercial and community solar industry are the requirements for federal Investment Tax Credit adders, direct pay, and transferability.

A lot of guidance from the Internal Revenue Service has arrived in the last few weeks, with more expected soon. While key uncertainties remain, we found it helpful to summarize some of the most important items for solar’s middle market. Here’s our take on what we know so far and what seems most important for commercial and community solar projects. Thanks to the folks at Sheppard Mullin and Norton Rose Fulbright for their accessible and timely write ups on key IRS announcements referenced below.

Guidance Overviews

ITC Transferability - Guidance Overview

Energy Community - Guidance Overview

Energy Community - Map

Domestic Content - Guidance Overview

Domestic Content - Qualification Analysis

Environmental Justice / LMI - Guidance Overview

Wage and Apprenticeship - Guidance Overview (>1MWac)

Conductor’s Analysis

IRA Key Takeaways - Conductor’s Analysis

The IRA’s ITC Growth Spiral - Conductor’s Analysis

Impacts of Direct Pay and Transferability - Conductor’s Analysis

ITC vs. PTC for Solar Projects - Conductor’s Analysis

ITC Direct Pay

At the time of this writing, we are still awaiting guidance from the IRS on how ITC Direct Pay will work for nonprofit and public organizations.

ITC Transferability

Entities structured as a “for profit” who wish to sell an ITC for cash can now do so, and market pricing for these transfers looks to be in the range of 90 to 95 cents on the dollar. So the owner of a solar project with an ITC worth $100,000 might expect to receive between $90,000 and $95,000 in cash from a one time transfer of this credit. It’s important to note that depreciation benefits remain with the system owner and are not transferred along with the ITC.

While the seller of the tax credit is required to maintain the system and continue owning and operating it, the buyer is at risk of losing the tax credit if something changes. So in practice, buyers will require indemnities from sellers with protection from these events. And buyers will perform due diligence on the projects they are considering for tax credit transfers. Transfers are considered passive investments for tax credit buyers, which can only be used to offset passive income. So most individuals will have a hard time being tax credit buyers.

Here’s more information on ITC transferability

Energy Communities Bonus Credit

A solar project located in an energy community can receive a 10% bonus credit on top of the base 30% ITC and any other applicable adders. The project must be in an energy community either when it starts construction or when it is placed in service. This safe harbor certainty is important as some locations could technically lose their energy community status in the middle of construction. Any of three types of location can qualify as an energy community:

Brownfields

Locations near closed coal mines

Statistical areas with employment and local tax collection tied to fossil fuels and higher than average unemployment

Here is a Map from the Department of Energy identifying the latter two.

Here’s more information on the Energy Communities Bonus Credit

Domestic Content Bonus Credit

A solar project can also receive a 10% bonus credit if it is made with sufficient domestic content - construction materials and manufactured components produced in the US. Construction materials, primarily structural components made of steel or iron, must be 100% US made. Manufactured products, including most electrical components, must meet a threshold for the percentage of costs manufactured within the US. The formula for this can be complicated. The threshold for qualification requires domestic content in manufactured products of 40% initially, shifting to 55% over time.

While many solar panel and inverter manufacturers are moving production to the US to help projects qualify for this bonus credit, several have expressed concern about the requirement to share their detailed cost information. Because most of these new manufacturing facilities for solar panels are still in construction, few panels are yet available that meet the criteria.

Here’s more information on the Domestic Content Bonus Credit Qualification and Guidance.

LMI Bonus Credit

A solar project can also receive a 10% or 20% bonus credit if it is located in a low- and moderate-income area or aimed at serving low-income households. Unlike the other bonus credits, which apply to an unlimited number of new solar projects, the LMI bonus credit has an annual cap of 1,800 MWdc of tax credits per year.

Importantly, no credits will be given to projects that are already in service when the awards are made. But developers have four years to complete a project after receiving an allocation.

Priority for the LMI bonus credit will be given to projects owned by non-profits, governments, Indian tribes, electric purchasing cooperatives, and specific types of organizations with experience installing or operating PV systems in low income areas. Priority will also be given to projects in areas with persistently high poverty rates over the last 30 years and disadvantaged census tracts.

Here’s more information on the LMI Bonus Credit

Wage and Apprenticeship Requirements

For projects over 1MWac, the IRS has additional wage and apprenticeship requirements. Mechanics and laborers must be paid the same “prevailing wages” that are paid on federal construction jobs. And between 10% and 15% of the total labor hours for a project must use qualified apprentices.

Importantly, prevailing wage requirements apply not only to the initial construction of a project but also to any alteration or repair on the project for the next 5 to 12 years.

For more information, here is a summary of guidance on Wage and Apprenticeship Requirements

Remaining Uncertainty

While the guidance from the IRS has been helpful in clarifying how key aspects of the Inflation Reduction Act will be implemented, significant uncertainty remains. For example:

Which manufacturers will be willing to share their cost information sufficient to support the calculations required for their products to qualify for domestic content?

And which components by which manufacturers will ultimately qualify?

How quickly will the blocks for the LMI adder be allocated and “used up” within a particular calendar year?

How the Market is Managing Uncertainty

These and other key questions remain for pricing projects. In the context of uncertainty about ITC adders, developers and investors are managing this situation with pricing scenarios. Developers are requesting and investors are providing bids at multiple ITC values (e.g. 30%, 40%, or 50%) and contracting at the more conservative value with specified increases in the budget or decreases in the offtake rate tied to specific adders coming through for the project. With Energy Community guidance out, most investors are now contracting at a 40% ITC base rate for those projects.

A Step-By-Step Guide to PPA Pricing with Conductor Solar

In our last post we noted some key variables in PPA pricing and highlighted why it’s important to price PPAs on a deal-by-deal basis. But how do you do this efficiently, without perfect project information? What is the right starting place for a new project?

Here we’ll outline a step-by-step process, made fast and easy by Conductor’s autopricing. We’ll use a PPA example, but the same sequence applies to leases and ESAs.

1. Make sure you’re in the range

The truth is that project economics don’t always support PPA financing. It’s important early on in the sales process simply to know whether or not pursuing a PPA will be worth your time. With Conductor, you can quickly check to see if a project will pencil with these steps:

Set up the project in Conductor to solve for the budget by selecting EPC + Dev Fee as the investor pricing request

Enter the highest sellable value for the PPA:

Set the PPA term length to 25 years and the PPA rate escalator to 2% per year

Set the initial PPA rate at a 10% discount to the customer's avoided cost of power. (for example, if the customer is currently paying $0.10 / kWh, set the initial PPA rate at $0.09 / kWh).

Input all other project details, as available

Generate your automated pricing estimate

If this estimate returns a budget that covers your costs and meets your business objectives, then the project’s economics likely support PPA financing.

How to use this in the sales process

This is a great screening tool to determine whether or not it makes sense to bring up a PPA in a conversation with the customer. If these economics work, and the customer seems interested in a PPA, then proceed to step two below. If the economics don’t work, a PPA is probably not a viable option.

How Conductor helps

Conductor answers this question quickly with an automatic price estimate. While it typically takes investors a week or two to respond with firm pricing, speed is key at this stage. With results validated by winning quotes from the marketplace, Conductor’s autopricing is also typically a better reflection of market pricing than a bid from an individual investor, as our model is based on hundreds of deals across the country

2. Optimize pricing for the project

Once you’ve determined that a PPA is an option for a customer, the next step is to start dialing in the pricing for the deal. Conductor makes this easy by allowing you to change inputs and re-run autopricing for a project as many times as you want. But unlike #1 above, there is no one right answer for the best way to do this.

When the project economics work for a PPA, some amount of extra value is usually available to be allocated to one party or another. One approach to this is to give all of the value to the customer and maximize your chances of winning the business. Instead of entering the maximum sellable PPA, as in #2 above, this involves entering the minimum.

Some customers prefer a low or zero annual escalator in their PPA rate, and reducing the escalator is one way to give additional value to the customer and increase the customer’s savings. Another is to lower the initial PPA rate beyond a 10% discount. How far can you lower the escalator and/or the PPA rate? It depends on the project economics. Once you reduce the EPC + Dev Fee to the lowest viable value for your project budget, you’ve basically allocated as much value to the customer as possible.

Another approach is to split the additional value with the customer, or try to claim all of it. This can work, and significantly increase your margin. But it could risk losing the deal to another company with better PPA pricing. So, it’s probably only viable in situations with less competition.

How to use this in the sales process

We recommend running scenarios like this to optimize deal pricing prior to mentioning a PPA rate with a customer. Customers can latch on to a number, and there are risks to setting their expectations either too high or too low. If anything, it helps to be a little conservative and start the PPA pricing conversation a little higher than you expect it to ultimately land. That way you can give the customer additional benefit and incentive for contracting as they get closer to signing.

How Conductor helps

Conductor allows for unlimited iterations with autopricing, so you can run as many scenarios as you want. Each scenario is informed by real quotes from investors in the marketplace. So while the results are still estimates, they still provide a very fast and reasonably accurate way to optimize pricing for any PPA deal. The kind of trade offs we’re focused on here (initial PPA rate vs. escalator, budget amount vs. customer discount) affect project economics in predictable ways. And this allows Conductor to anticipate the impact of these variables on investor pricing in the marketplace.

3. Firm up pricing in the marketplace

When it comes to firming up pricing, nothing beats a great bid from a high quality investor. We have a high degree of confidence in the ranges provided by our autopricing tool, but they’re still only estimates. When you need a firm price, it’s time to talk with an investor.

Receiving bids in the Conductor marketplace takes between a few days and a few weeks, depending on the complexity of the project. Once the bids are in, you can select a financing partner to work with and introduce them to the customer.

Before talking with investors, it’s very helpful to glean some information about the customer’s credit profile. If the customer is not a public entity or a rated company, additional information will be required to assess their creditworthiness. This can include the customer’s operating history and track record, but it ideally involves three years of audited financial statements. Investors may be willing to price a project without all of these details - contingent on a detailed credit assessment prior to contracting.

From there, the financing process generally follows this outline, and developers and investors work together to bring the project to fruition.

How to use this in the sales process

Generally, the need for firm pricing is driven by the customer’s timeline and level of interest. Sometimes they will sign a letter of intent (LOI) based on an estimate, and sometimes they will need more confidence to move forward. If a PPA quote is required in a customer’s RFP, we recommend connecting with investors right away.

But in most sales cycles, there are several conversations with a customer and some iterative system design work before the customer is ready to move forward. Autopricing is designed to support the earlier conversations, and the marketplace is designed to support conversations closer to contracting.

How Conductor helps

Conductor’s financing marketplace uses the same set of project data as autopricing. This means that everything you do to estimate and optimize customer pricing is saved in the app for use in the marketplace. All you have to do is submit the project. And with this same set of data, your project receives up to five bids from high quality investors who actually transact on that type of project. This saves a ton of time that would otherwise be spent searching for and comparing investor bids.

Easy as 1-2-3

Conductor’s autopricing and financing marketplace give you everything that you need to price and sell PPAs to C&I customers. Whenever a customer seems interested in a PPA (or a Lease or Energy Services Agreement) use these steps to help them understand their options, find a great investor, and close the deal.

The PPA Financing Process - An Updated Overview

Note - this is a refreshed post, originally made in April 2022. It incorporates the relevant aspects from the Inflation Reduction Act.

Download the complimentary PPA slide deck that accompanies this post (Click Here)

In part two of this series on selling power purchase agreements (PPAs), we’ll outline what to expect during each step of the process. For Conductor’s take on what PPAs are and when to use them, visit our blog post on the first part of the series located here.

Financing PPAs from Start to Finish

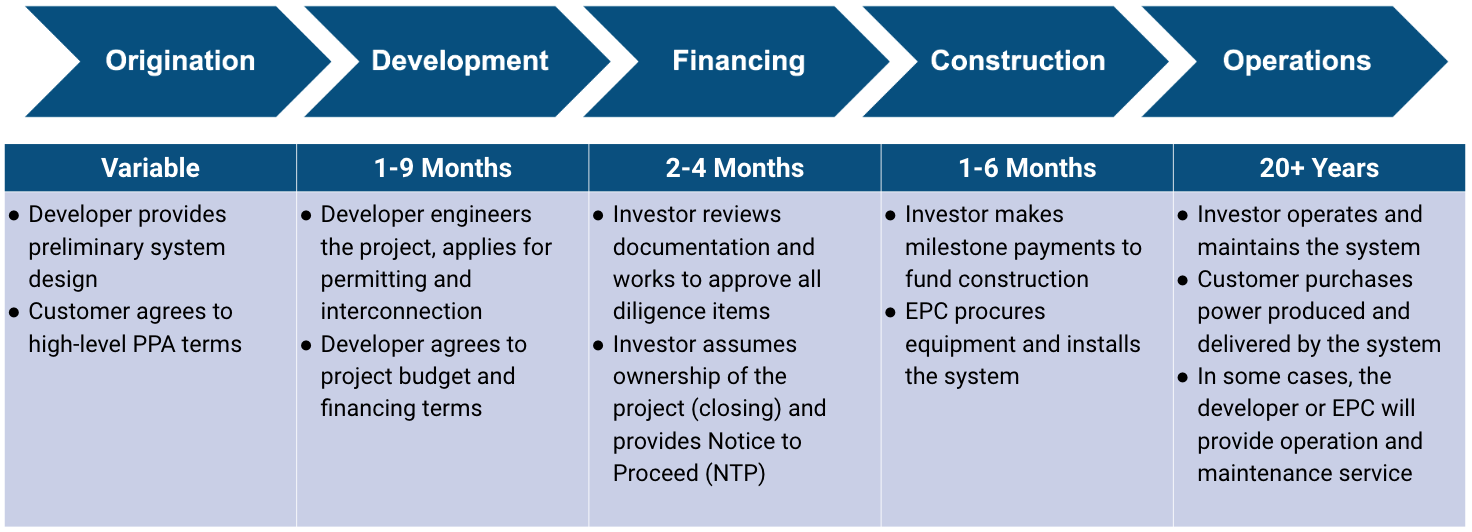

There are five main phases to C&I PPA projects, as seen in the table below: origination, development, financing, construction, and operations. Each of these steps has key deliverables and actions performed by the developer, the customer, and the investor. For Conductor’s take on these and other roles, see this post on solar terminology.

The process can take anywhere from a few weeks to over a year. Every investor would like to make this as short as possible. However, the highly customized nature of these systems necessitates a detail-oriented approach to diligence and acquisition.

Origination

In the origination phase, the developer sells the customer a PPA. This requires a preliminary system design and production estimate and often a PPA price provided through Conductor Solar. An estimated price can serve as a starting point, but a firm price quote for the customer should be provided directly by an investor. In some instances, origination is broken into a few key steps:

Developer designs the system and runs auto pricing on Conductor to estimate a PPA rate for the customer

Customer decides that a PPA is a better fit than owning the system, and provides information to indicate creditworthiness

Developer works through Conductor Solar to get a PPA quote from an investor

Developer, investor, and customer agree on the PPA rate and the high-level terms

Development

Once a PPA price is agreed upon with a system design in mind, then the real work begins. The developer continues to advance the project with a focus on the items needed for investor diligence and the required construction permits. The developer's main role in this phase is to finalize system specifications via engineering drawings and documentation, obtain approvals for permitting and utility interconnection, and complete any required environmental testing based on the type of system.

A key outcome of the development phase is an agreement between the developer and the investor on contract terms. This typically includes the schedule for milestone payments, the amount of the EPC contract and the Developer’s fee, and how these will change if the project changes. The result of these negotiations is a term sheet or Letter of Intent (LOI) between the developer and the investor. While this LOI can be entered into at any point during the origination and development process, a general rule of thumb is that the further advanced the project is, the more value it will command from an investor.

The customer remains involved throughout this process too. The investor works directly with the customer to negotiate the legal terms of the PPA and site easements, and the customer provides access for on-site assessments throughout the development and financing phases.

Financing

During the financing and diligence process, the investor confirms the key system parameters. Investors mainly focus on verifying the inputs to their financial model (e.g., production estimates, revenues, expenses, etc.) and ensuring that no unexpected risks are present (e.g., customer credit, environmental risk, technical risk, etc.). The following table outlines the items that investors will typically review prior to finalizing their acquisition of the project:

Investor review of diligence items often takes 2-8 weeks after the completion of all development work. The diligence timeframe may be longer if development items need to be completed. Conductor often sees projects that still have engineering reports outstanding (e.g. ALTA, Geotech, Phase 1 ESA, etc.) take as long as 20 weeks to close. Outliers exist on either side of this timing, but the goal is always to close as soon as possible. Diligence ends with executed project documentation, and the system is ready for construction.

Update following the Inflation Reduction Act

Investors often will provide a few different price scenarios depending on the expected ITC %. This can be challenging as the final ITC % may not be firmed up via policy or precedents until the system is built. Investors understand that, but they typically will agree to up-front pricing based on the lowest expected ITC scenario with firm pricing improvements that kick in as soon as higher ITC amounts are confirmed.

Construction

In the construction phase the EPC builds the system. Investors generally pay for development and construction with milestone payments specified in the EPC agreement and sometimes a distinct agreement between the developer and the investor. The following table outlines a typical structure for milestone payments:

This table approximates Conductor’s view of the most common set of milestone payments. However, there are a few reasons these may vary:

Developer needs a payment pre-NTP to finalize some of the development work

Investor purchases equipment on behalf of the EPC

Milestones are condensed into fewer milestones for exceptionally small projects and expanded into more milestones for larger projects

In some cases, developers and EPCs have access to construction financing and will fund the construction themselves to receive a higher price from an investor (due to the investor not taking on any construction risk or interest expense).

During active construction, investors often require weekly progress updates to ensure milestones are met and construction proceeds smoothly. They usually want to visit the site or have their independent engineer partner visit the site to confirm mechanical and/or substantial completion. Conductor recommends EPCs capture numerous pictures of the installation process along the way to minimize surprises later on.

After the system is constructed, the EPC commissions the system and completes system performance testing to validate that it works properly. Investors expect to own the system for 20+ years, so the goal of the testing is to make sure that there are no hidden problems in the installation and that the system performs as expected. Typically, systems must meet a minimum level of performance versus expected (e.g. 98%) or else the EPC is subject to penalties.

Operations

The previous steps in this process are designed to set up a 20+ year period of operation with minimal interruptions or surprises. The investor owns the system and gets paid for the power produced, and the customer pays for the power received from the system. The investor also contracts for ongoing operation and maintenance (O&M), which involves active monitoring of the system and periodic inspections required to maintain equipment warranties. If any issues arise, the investor works to remediate them so that the system continues producing power.

One of the key benefits of a PPA agreement is this alignment of incentives between the investor and the customer. The customer wants to keep buying power from the system, because it’s less expensive than the rate from their electric utility. The investor wants to keep producing this power for their key revenue stream as a system owner. And the investor, as the long-term owner, has all of the data and access and contracts to maximize production and deliver this benefit to all parties.

The PPA financing process is a multi-stage collaboration between developers and investors. Developers prepared to go through the process are more successful and close deals faster than those that are not. Conductor’s experience with developers, EPCs, and investors across the country informs our approach to helping deals get financed as smoothly as possible.

Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.

Power Purchase Agreements: An Updated Overview

This post outlines the basics of a Power Purchase Agreement (PPA) structure for getting solar projects financed.

Note - this is a refreshed post, originally made in April 2022. It incorporates the relevant aspects from the Inflation Reduction Act.

Download the complimentary customer-facing PPA slide deck that accompanies this post! (CLICK HERE)

Power purchase agreements (PPAs) are an integral part of the commercial solar market, which consists of projects with schools, municipalities, private companies, non-profits, etc. PPAs make up 70% of sales in the annual $8B middle market. However, many developers and installers struggle with the mechanics of a PPA: when to sell it, how to price it, and what to expect after the sale is made. As such, PPAs often end up with a more complicated sales process than their cash purchase counterparts.

In this two-part series (check out part 2 here), Conductor Solar will explain what PPAs are, when to use them, and what to expect during the financing process. For the purposes of this series, Conductor will assume that any system discussed is of sufficient size and creditworthiness to warrant a third-party project investor. Conductor endeavors to give its partners the tools to make selling PPAs simpler, as well as to prepare installers for the post sale work that project investors typically require before an acquisition is complete.

How PPAs Work

The primary difference between a cash purchase and a solar PPA is that an unaffiliated project investor owns and operates the system, and sells the power generated from it to the customer for a fixed and known price over 20+ years.

The customer typically receives a 5-20% savings on their cost of power in year 1, with a projected increase in savings over time due to rising utility costs. Under a solar PPA, the project investor receives all the tax benefits associated with the system, particularly the Federal Investment Tax Credit and depreciation benefits. This is important as many commercial entities are unable to use the tax benefits associated with solar because they don’t have enough tax liability. Thanks to the Inflation Reduction Act (IRA), public and NGO entities who do not pay taxes are now able to request a direct payment from the IRS in lieu of a tax credit. This lessens the need for a PPA, but those entities are still unable to value any depreciation and often are still choosing to pursue PPAs for reasons mentioned below.

When to use PPAs

PPAs are often the answer for commercial systems due to any number of the large required capital expense, lack of technical expertise or lack of tax appetite of the customer. However, other factors may influence the decision, too. The table below outlines the key determinants for a cash purchase or a PPA:

In both a cash purchase and a PPA, the customer is the system host, just with different obligations. Under a PPA a customer has fewer responsibilities, namely paying their bills and making sure the system owner can access the site to provide required maintenance on the system. The project investor is responsible for insurance, operation and maintenance, repair coordination, and managing incentives.

Discussing PPAs as an Option with Customers

PPAs are not only for those organizations that have low or no tax liability. Some organizations prefer to finance the system and have someone else operate it. Some questions the customer can answer to help with decision making are:

If you’re a for-profit organization, do you have enough tax liability to use tax benefits from the system?

Does your organization allow you to make a capital expenditure of this size?

Are you comfortable taking on obligations to your balance sheet?

Do you have a loan financing option, and does it provide you with savings/a reasonable ROI?

Is your organization prepared to provide financials to a project investor for credit review?

By understanding the answers to these questions, installers can better help their customers decide whether a PPA is right for them. The biggest difference between financing with a loan as compared to a PPA is that loans represent on-balance-sheet financing and the customer has to carry a long-term liability. PPA payments are treated as an expense, so the PPA never shows up on the balance sheet.

Contact the Conductor Solar team (Support@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.

Solar Dialects

At Conductor we’re a part of numerous conversations between solar developers and investors, and we’re often surprised with how different the lingo can be from company to company. But it’s also really important that developers and investors share an understanding when considering comprehensive agreements for development, financing, and construction. It’s good to have a sense of humor about these things, and also some patience when working through the terminology.

We wrote this post to highlight common areas of confusion, and some key questions to ask for clarification.

It’s the system, man! Getting specific about system pricing, size, and production

“We’ve got a 1MW project and we want to sell it for at least $3M”

This could be said by one party, heard perfectly by another, and understood very differently. Some people talk about system size in watts DC and others in watts AC. Without specifying one or the other, there is ample room for misunderstanding. In this example, a DC system size implies a price of $3.00/W while an AC system size implies a price closer to $2.00/W. People can get pretty far into a conversation before recognizing misalignment on this basic point, and it often stems from groups moving down from utility scale work into the smaller end of the market.

But what if this speaker had said “three” as a shorthand for “three million”? This could also be interpreted as $3/Wdc, which puts the price of the 1MWac project at $4.5M. Unless we specify Wdc vs. Wac and $ vs $/W, there is potential for confusion on both the price and the size.

“The production’s at 1.4, but we might hit 1.6 with trackers.”

Does this refer to 1,400,000 - 1,600,000 kWh per year, or a production ratio of between 1,400 and 1,600 kWh/kWdc? People quote production both ways, and can be surprised when they see something that differs from what they heard. We support both in Conductor, and production data entered the wrong way can throw a financial model off by a few orders of magnitude.

But don’t confuse a production ratio with a “performance ratio” that describes the actual vs. theoretical energy outputs of a system, in the form of a percentage. In addition to showing poor economics, production ratios less than 1 raise some basic questions about system design (zero degree azimuth / north-facing panels?).

Conductor’s view: Most confusion around system specifications and pricing comes from people talking in different units. Because the vernacular differs, it helps to be explicit about the denominator. This kind of misunderstanding quickly gets clarified in further discussions. But these are exactly the kind of high level conversations that people have to determine whether or not they’re interested in a project at all. And basic misunderstandings can mean the difference between having those further discussions or passing on a deal entirely.

Where are we at? Clarifying project status and development milestones

“We’ve got site control.”

This might be completely true and at the same time not enough. Site control can be obtained through a license, an easement, or a lease and some investors are okay with any of these while others have specific requirements. As with most things in solar financing, the difference really manifests itself when things go wrong in the project. A license is much less secure and buttoned up from a real estate law perspective compared with site easements and leases.

“Your production looks about right.”

This is usually said to mean that the current production estimate is likely to be within a few percentage points of the production forecast from an independent engineer (IE). But it’s important to note the approximation here. A swing of a few percentage points will materially affect the final purchase price of a project. Experienced developers understand this uncertainty and budget accordingly, but developers newer to PPA projects can be surprised when the production estimate that they thought was “vetted and done” comes back from the IE with a haircut that clips their development fee. This risk can also be reduced with proper production modeling similar to how a polished IE would look at it, factoring in nuances like monthly soiling losses and using a top tier data set for the base GHI.

“This one is NTP ready!”

NTP, or Notice to Proceed, is a green light from an investor to begin construction. It follows an investor’s diligence process, and is a key milestone for keeping a project on schedule. But what makes a project ready for NTP? Some use this phrase simply to mean that the customer has signed a PPA. Others use this to mean that not only is the PPA signed, but interconnection has been approved by the utility and all the required permits have been received from local authorities. These two interpretations can be a year plus apart! In addition to specifying a target date for NTP, it’s important to clarify its associated requirements.

Conductor’s view: We haven’t seen a project yet that didn’t change at least a little bit through the course of its development. Every number and every date is an estimate until it’s finalized. What we’ve found most helpful here is some extra attention to these items, and an interest in clarifying what is needed to finalize them. It's important for developers to understand investor requirements alongside investor bids. And these conversations can surface key development items and a shared sense of how “baked” the project is.

Who are we talking about? Describing the key parties in a solar deal

“We all do development, but we aren’t all developers.”

Because middle market deals have been so challenging to get done, most of the parties involved have gotten their hands into development work at one time or another. Especially when branching out into a new type of project, it takes a certain amount of flexibility and creative collaboration to make things happen. But that doesn’t make everyone a developer. We’ll parse this from other roles as we go along here.

“Can they EPC that?”